Many cat owners eventually ask the same question: how much is cat health insurance? With veterinary care becoming more advanced and treatment options expanding, unexpected medical bills can quickly add up. Cat health insurance is designed to help manage these costs, but understanding what you might pay—and what you get in return—can feel confusing.

This guide explains cat health insurance costs in a simple, transparent way. Instead of fixed prices or promises, you’ll learn how insurance is generally structured, what factors influence the cost, and how to decide if it fits your situation.

What Is Cat Health Insurance?

Cat health insurance is a financial agreement that helps cover certain veterinary expenses. You pay a regular fee, and in return, the policy may reimburse eligible medical costs if your cat becomes ill or injured.

Insurance typically works by:

- Paying veterinary bills upfront

- Submitting a claim

- Receiving reimbursement based on your plan

Coverage and cost vary depending on multiple factors.

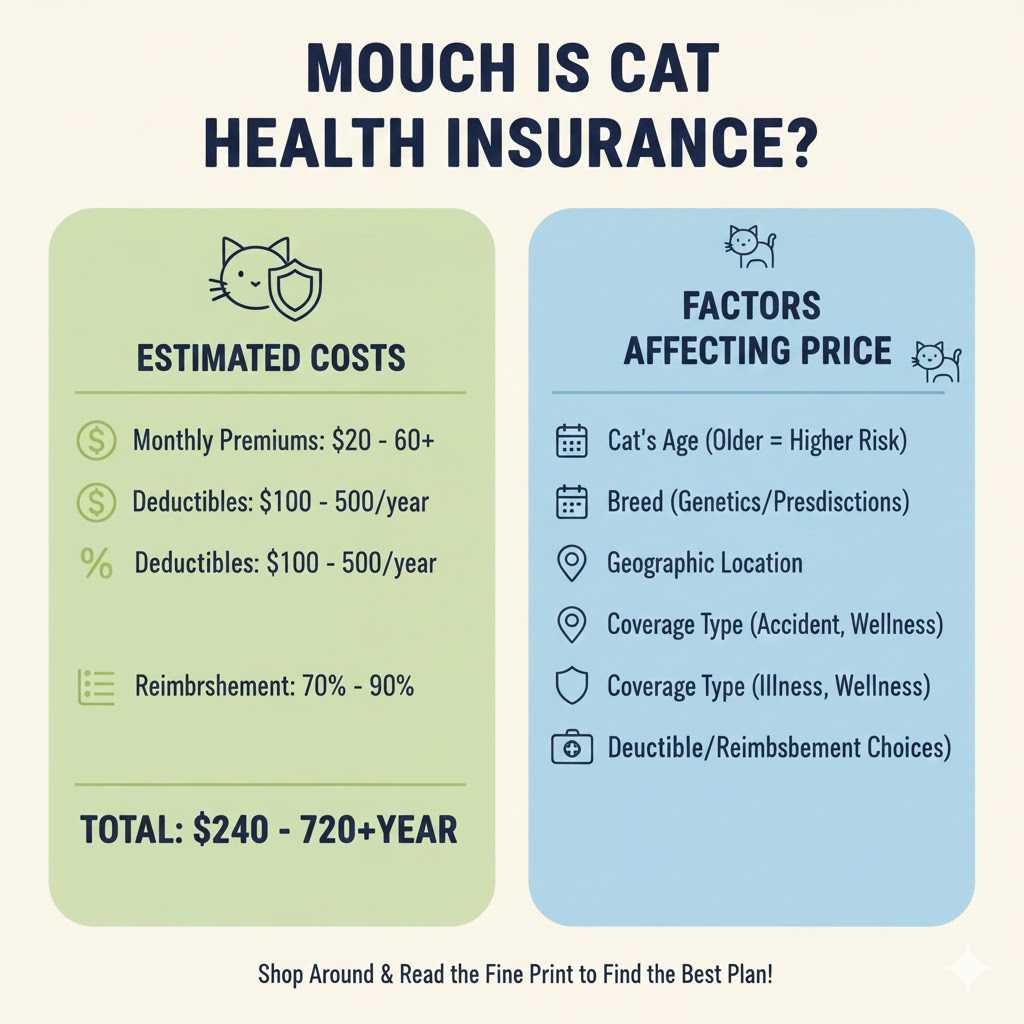

Average Cost Range of Cat Health Insurance

While exact prices differ, cat health insurance generally falls into a moderate monthly range compared to many other pet expenses.

Costs usually depend on:

- The type of plan

- Coverage limits

- Deductibles

- Reimbursement level

Some plans are designed for basic accident coverage, while others include illness, diagnostics, and long-term care.

What Factors Affect the Cost of Cat Health Insurance?

Several key elements influence how much cat health insurance costs.

Your Cat’s Age

Age plays a major role in insurance pricing.

- Younger cats typically cost less to insure

- Older cats may have higher premiums

- Some conditions are more common as cats age

Starting insurance early can sometimes offer more options.

Breed and Genetics

Certain cat breeds are more prone to specific health conditions.

Insurance providers may consider:

- Known breed-related risks

- Size and lifespan trends

- Genetic predispositions

Mixed-breed cats often fall into average pricing ranges.

Type of Coverage Chosen

Not all insurance plans are the same.

Common plan types include:

- Accident-only coverage

- Accident and illness coverage

- Comprehensive plans with diagnostics

More coverage usually means higher monthly costs.

Deductibles

A deductible is the amount you pay before insurance helps cover expenses.

- Higher deductibles usually lower monthly costs

- Lower deductibles increase monthly payments

Choosing a deductible depends on how much you’re comfortable paying upfront.

Reimbursement Percentage

This determines how much of the eligible cost you get back.

Common reimbursement levels:

- Lower percentage = lower monthly cost

- Higher percentage = higher monthly cost

This balance affects both monthly payments and claim payouts.

Coverage Limits

Some policies set limits on how much they pay.

Limits may be:

- Annual

- Per condition

- Lifetime

Higher limits usually increase the cost of the plan.

What Does Cat Health Insurance Usually Cover?

Coverage varies, but many plans include:

- Accidents

- Illnesses

- Diagnostic tests

- Hospital stays

- Surgery

- Medications

Some plans may also offer optional add-ons.

What Is Usually Not Covered?

Most cat health insurance policies exclude certain expenses.

Common exclusions include:

- Pre-existing conditions

- Routine grooming

- Cosmetic procedures

- Preventive care unless added separately

Reading policy details helps avoid surprises later.

Is Cat Health Insurance Worth the Cost?

Whether insurance is worth it depends on your situation.

It may be helpful if:

- You want predictable monthly expenses

- You want help with unexpected medical costs

- You prefer financial peace of mind

Some owners prefer saving money monthly instead, while others value insurance protection.

Monthly Cost vs Unexpected Vet Bills

Many people underestimate veterinary costs until an emergency happens.

Unexpected expenses may include:

- Emergency treatment

- Surgery

- Imaging tests

- Long-term medication

Insurance helps spread risk over time rather than paying everything at once.

Indoor vs Outdoor Cats

Lifestyle also influences insurance value.

Outdoor cats may face:

- Higher risk of injuries

- Exposure to illness

- Accidental trauma

Indoor cats may have fewer risks but still face health issues.

Does Location Matter for Pricing?

Veterinary care costs can vary by area, which may influence insurance pricing indirectly.

Insurance plans consider:

- Average veterinary fees

- Access to specialty care

This can affect premium ranges without guaranteeing fixed prices.

How Cat Health Insurance Claims Usually Work

Understanding claims helps set expectations.

Typical steps:

- Visit a veterinarian

- Pay the bill

- Submit a claim

- Receive reimbursement

Processing time and reimbursement depend on the policy terms.

Can You Change or Cancel a Policy?

Most policies allow:

- Plan upgrades or downgrades

- Adjustments to deductibles

- Cancellation with notice

Terms vary, so reviewing policy flexibility is important.

Does Insurance Cover Chronic Conditions?

Chronic conditions may be covered if:

- They are not pre-existing

- They develop after coverage begins

Ongoing conditions may affect future premiums.

Insurance for Kittens vs Adult Cats

Kittens

- Lower premiums

- Fewer exclusions

- More long-term coverage options

Adult Cats

- Slightly higher premiums

- Some coverage restrictions

- Still eligible for many plans

Common Myths About Cat Health Insurance

“It’s Too Expensive”

Monthly costs are often manageable compared to emergency bills.

“I’ll Never Need It”

Unexpected accidents and illnesses can happen at any time.

“It Covers Everything”

Insurance has limits and exclusions, like most policies.

How to Decide the Right Coverage Amount

Ask yourself:

- Can I afford unexpected vet bills?

- Do I prefer steady monthly costs?

- How old is my cat?

- What health risks concern me most?

The answers help guide plan selection.

Tips for Managing Insurance Costs

Without specific strategies, many owners find balance by:

- Choosing moderate deductibles

- Avoiding unnecessary add-ons

- Reviewing coverage annually

Flexibility allows adjustment as your cat’s needs change.

Read Also : Why Does My Cat Lay on Me

Frequently Asked Questions

Is cat health insurance mandatory?

No, it is optional and based on personal choice.

Does insurance pay vets directly?

Usually, reimbursement is provided after payment.

Can I insure more than one cat?

Yes, policies are usually per cat.

Does insurance cover dental care?

Some plans include dental issues related to illness or injury.

Will premiums increase over time?

Premiums may change due to age or policy adjustments.

Conclusion

So, how much is cat health insurance? The cost depends on factors like age, coverage type, deductibles, and reimbursement levels rather than a single fixed price. Understanding these elements helps you decide whether insurance fits your budget and your cat’s needs.

By viewing cat health insurance as a long-term support option rather than a guaranteed savings plan, you can make a confident, informed choice that prioritizes both financial stability and your cat’s well-being.